By Jesse Floyd

Correspondent

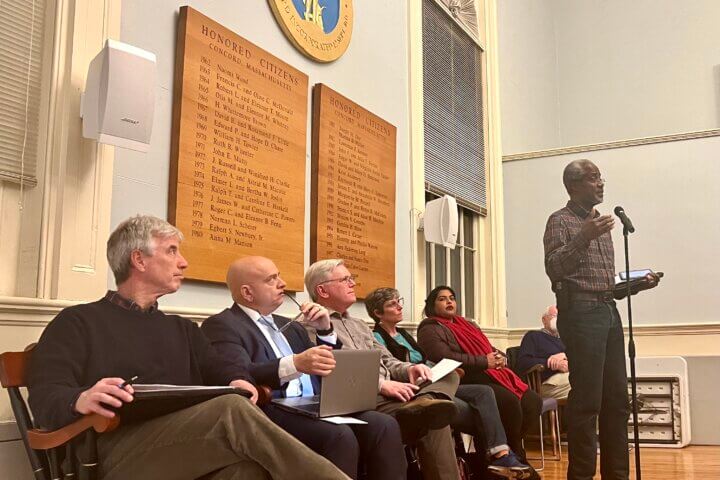

Finance Committee member Lois Wasoff kicked off Town Meeting with a presentation carrying a simple warning: Budgetary priorities must change or the town could end up foundationally different.

Right now, long-range projections indicate Concord will be spending more than it takes in for at least the next five fiscal years. That, Wasoff said, is unsustainable. If left unaddressed, it could, and probably will, lead to Proposition 2 ½ overrides to fund the operating budget.

But closing that gap between expenses and revenue isn’t going to be easy.

Finance Committee Chairman Parashar Patel said he wants to work with the school department to moderate their budget increases. “Without changing their cost curve, residents will face higher taxes and/or reduced town services,” he said.

A joint meeting is planned for July with the FinCom, School Committee and town staff to better understand the budget process for each entity in advance of the next fiscal year.

The options are simple: Either the town needs to cut costs or the town needs to find ways to raise revenue to close the gap.

According to Town Manager Kerry Lafleur, increasing revenue is a front-of-mind topic in her office right now. Real planning and discussion on the issue can’t really start until later this summer, after all the details from Town Meeting are settled, she said.

“This is something we’ve been flagging for a number of years,” Lafleur said.

Each year, the town puts together five-year financial projections to assess the health of the town budget. According to Lafleur, those projections tend to show the need for a Proposition 2 1/2 override about two years in the future.

“This is something we are going to do over the summer. There are a number of possible revenue sources we are going to start looking at,” Lafleur said.

It’s not easy to find ways to increase revenue, Lafleur said. One topic of conversation that’s getting some attention is PILOT agreements with some of the town’s non- or not-for-profit entities. PILOT (payment in lieu of taxes) agreements are negotiated between non-profits, which don’t pay property tax, and the town.

Lafleur cited the success Lowell has found striking PILOT deals with the UMass system. UMass-Lowell has been buying up property in the city as the school grows. The result takes once-taxable land off the tax rolls.

“This was something that, 15 years ago, was not all that common,” she said.

PILOT agreements are just one area that will be explored.

“That is just one topic on my list right now that we will be discussing over the course of the summer,” Lafleur said.