Concord will be paying off the cost of building a new middle school for a long time to come – up to 30 years.

After construction cost estimates increased during COVID, a Special Town Meeting in 2023 followed by a town election approved borrowing an additional $7.2 million, adding up to $110 million up from $102 million approved a year earlier. Unlike other recent school building projects, the state is not funding part of the construction expense.

The debt exclusion cost is projected to be around $1,152 per year for a median-priced home starting in fiscal year 2025 by the time that all borrowing hits to tax rolls, according to a presentation at Town Meeting in January. The loan payments will have a term of 25 to 30 years.

The increase to the tax bill has citizens concerned.

“I’ve noticed the level of stress is up,” said Select Board Chair Matt Johnson.

“What’s at stake here is pretty big,” he said. “It’s too expensive to stay. We’re losing the families that have been here for generations.”

Finance officials are looking at ways to cushion the tax increase, perhaps staggering the debt by borrowing in phases. In June 2022, the town borrowed $12 million toward the project. That debt is already in the property tax bills.

Other options include using a level debt service, where the payments are roughly equal over the years. The town could choose to use the Middle School Stabilization Fund in the early years of the loan term.

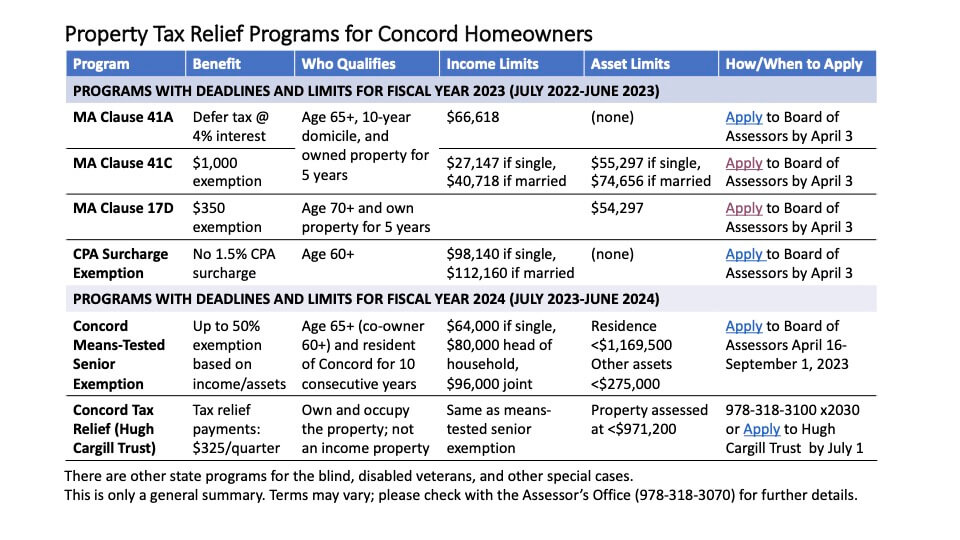

Already, seniors, veterans and their families, and some disabled homeowners have several options they can use to moderate the impact of the tax increase. Eligibility is based on age, income and residency requirements.

Those seeking tax relief must opt in by applying annually.

Working with town staff, Johnson prepared a sheet listing options available through the town. His list is available on theconcordbridge.org. More details and applications are on the assessing office’s website at concordma.gov.

One of the programs listed is the Hugh Cargill Trust. This is funded by donations, said Dinny McIntyre, chair of the Tax Relief Committee and a member of the board of The Concord Bridge.

Currently, the fund provides 58 households with tax relief and additional households with other bills such as car repairs or utility bills. The most the trust has raised in a year is $100,000, which will not help everyone who needs assistance, McIntyre said.

The increased tax for the middle school construction “is a pinch for people who are on fixed incomes,” she said. McIntyre urged Concordians to make a tax deductible contribution to the fund by mailing a check to Shannon McAndrew, Town House, P.O. Box 535, Concord. Donors can indicate on the memo line if they want their contribution to be used for tax relief or for general assistance.

A state program, the Senior Circuit Breaker Tax Credit, allows a maximum tax credit of $1,200 for each qualified senior homeowner or renter. Applicants must complete a CB schedule with their state tax returns. More details are available at mass.gov/dor

The Select Board and the assessor’s office have been in conversations for a while, searching for a solution to blunt the impact on the most vulnerable people in town, Johnson explained.

Currently Clause 41C allows a $1,000 tax exemption for some seniors. This year only three people used it and the assessors are concerned that not everyone knows about the program, despite yearly presentations at the Council on Aging, said David Karr, the chair of the Board of Assessors and a former chair of the Tax Fairness Committee.

The town could choose to drop Clause 41C and instead implement Clause 41C 1/2, he said. The town can set higher income and asset limits, making it available to more homeowners.

Under 41C 1/2 Town Meeting can exempt up to 20% of the average assessed valuation of a home for qualifying residents, Johnson said.

The expanded program would take time to get started, Karr emphasized. Before going to Town Meeting, the switch to 41C 1/2 must be approved during a local election.

The Select Board could enact a different program without voter approval – an opt-in residential exemption. The tax exclusion is for primary residences but not for rental properties. Johnson said the Select Board could choose to exclude up to $350,000 of a home’s valuation for taxes.

There is a lag between acceptance of the exemption and its implementation. For example, if approved in fall 2023, Johnson said, the change could not take effect until fiscal year 2025, which begins on July 1, 2024, coincidentally at the same time the greatest impact of the middle school funding hits.

While the Select Board can implement the exclusion on its own, “we shouldn’t just walk into the room and do it,” Johnson said. In effect, the exclusion would create a progressive tax where the wealthy pay more.

The town’s tax levy, the total amount of tax collected, remains the same, even when people opt-in to any of these potential exemptions. As a result, the tax rate, the amount charged per $1,000 of value, will increase.

About a third of the homes in town, with values around $1.38 million will end up paying roughly the same amount in taxes whether the broader exemptions take effect or not, Karr said. Those owning lower priced homes will pay less and those with more expensive homes will pay more if taxpayers opt-in to a residential exemption, causing the tax rate to increase.

Higher taxes on some are not the only hurdle the town will have to overcome if more exemptions are allowed.

“It’s going to be hard to get into,” Karr said. A roughly $2 million overlay account is available for the assessors to tap into after a taxpayer gets an exemption in order to meet the levy.

The town will need to increase the overlay account so sufficient funds are available if more people use exemptions. “Taxes are going up before they go down,” Karr said.

“We can’t beef it up too much because of Proposition 2½,” he said. Unless voters approve an override or a debt exclusion, the tax levy can increase by only 2½% yearly.

“It will take time to get there,” Karr said.