The impact of The Community Preservation Act (CPA) is visible all around Concord: the Bruce Freeman Rail Trail project; White Pond and Emerson Field improvements; Assabet Bluff Affordable Housing development; Old Manse and Wright Tavern restorations; the Main Library expansion and Fowler Library renovations; and many other valued assets.

What is the CPA and how is it administered in Concord? The CPA is a Massachusetts State law enacted in September 2000, which allows communities to create a local Community Preservation Fund four purposes: open space protection, historic preservation, affordable housing development; and outdoor recreation. The law has empowered each city or town to decide independently whether to adopt the act. The Town of Concord did so at Town Meeting in 2004. and it was ratified at the polls in November 2004. Concord voters agreed to fund the CPA account through a 1.5 percent surcharge on real estate property tax bills with two exemptions:

- Residential property owned and occupied by any person who qualifies for moderate- or low-income housing or low or moderate-income senior housing.

- The first $100,000 of the taxable value of a residential property.

Those funds accumulated annually from the local tax base are supplemented by state funding.

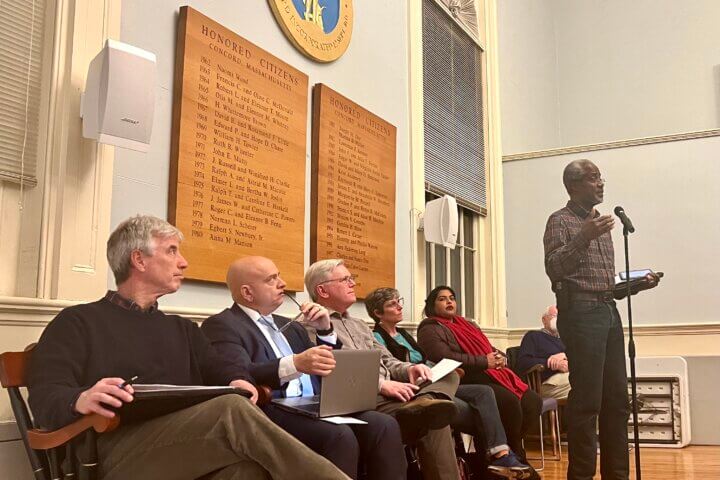

In Concord, the Community Preservation Committee (CPC) is responsible for annually evaluating applications for CPA funds. The procedures under which the CPC operates and those specifying the application process can be found on the CPC’s website under “CPA Grant Applications and Instructions.” Composed of eight members, the CPC has broad representation: four members are appointed by the Select Board and four are appointed by other town committees, namely the Natural Resources Commission, the Recreation Commission, the Historical Commission, the Planning Board and the Housing Authority. Over its 18-year existence in Concord, more than $28million in CPA funds have been granted to applicants for 125 diverse projects, averaging about $1.6 million every year. Individually funded project sizes range from $6,000 to $1.5 million. You can find a list of those projects on the CPC website in “Distribution of CPA Funds 2006-2022.”

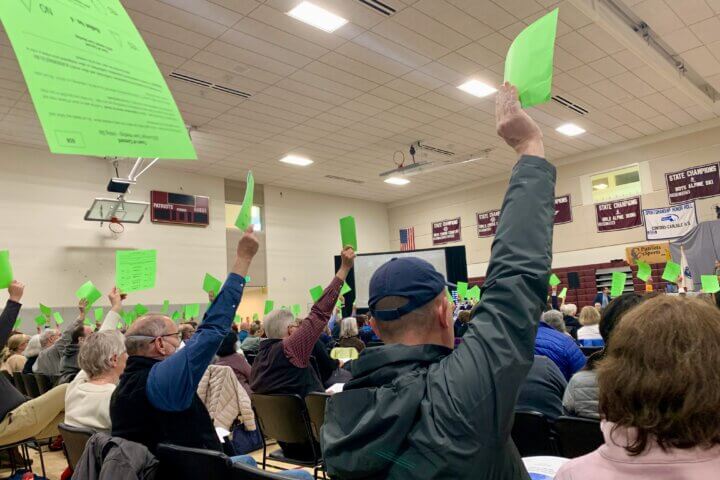

While the full slate of CPC-recommended projects is reviewed each year by the Finance Committee and Select Board and appears as a Warrant Article at Town Meeting (see Warrant Article number 26 in this year’s Warrant) for voter consideration, the CPC believes that public awareness and participation is extremely important. This participation includes knowledge of the projects being proposed each year for funding and additional participation in the development of new projects in close coordination with relevant Town Departments and Committees.

Applications for project funding for fiscal year 2025 are due on September 8. Although the application procedures are clearly presented on the CPC website, the CPC would like to invite all interested individuals and groups to attend one of two virtual informational sessions on April 18 and May 16 to learn more.

For further information on the CPC and procedures and the informational sessions, contact planningdivision@concordma.gov.