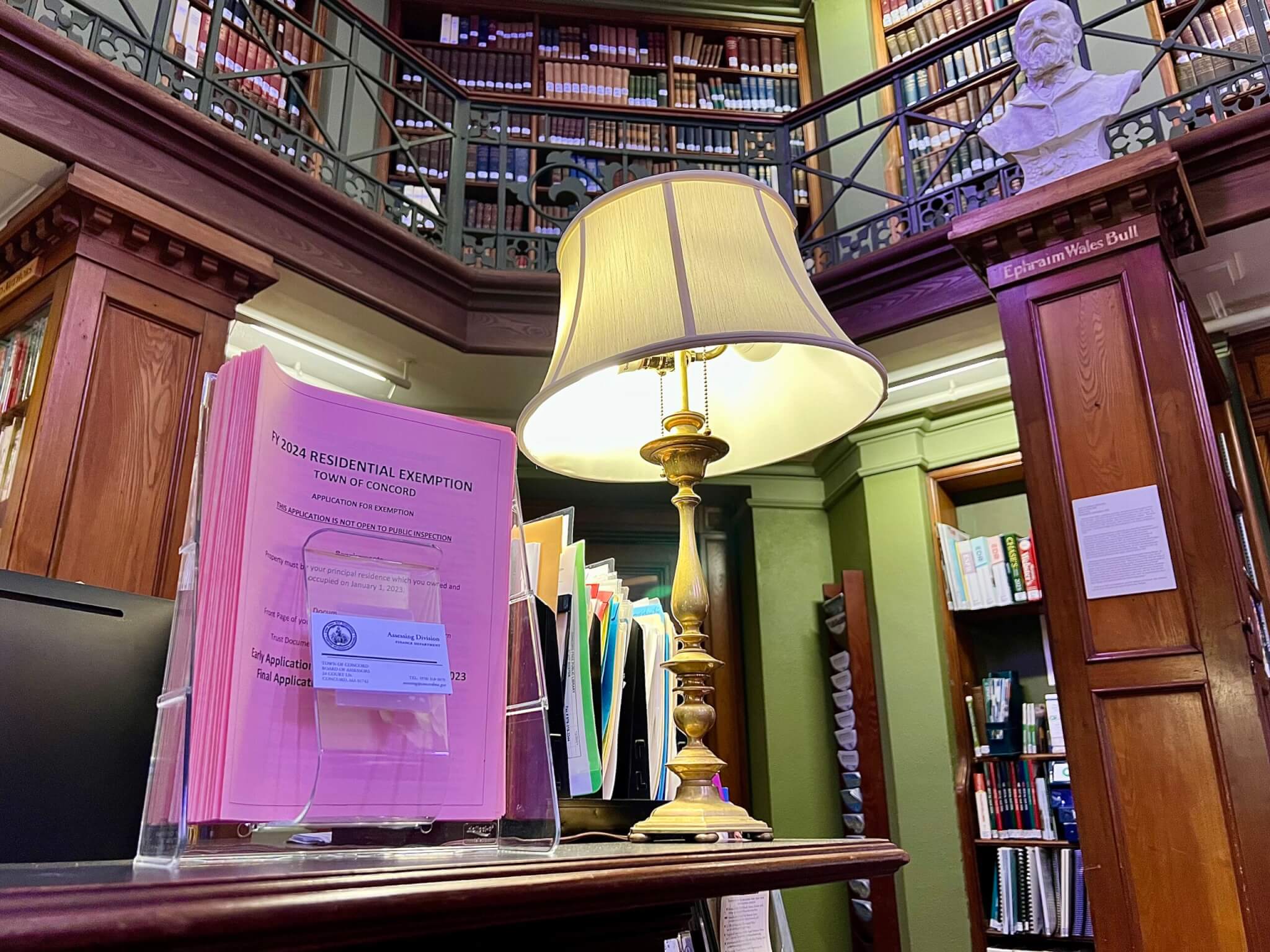

Deluged with early applications for Concord’s new residential tax exemption, the town assessor’s office is limiting the hours it’s open to the public through November 1.

As of Monday, the assessing division had fielded more than 2,000 exemption applications, according to Office Administrator Carolyn Dee.

“The assessor’s office is a bit overwhelmed with the volume of applications coming in and questions that they are receiving,” Town Manager Kerry Lafleur told the Select Board this week. “So for the next few days, they’re going to adjust their hours.”

Through November 1, the close of the early submission period for exemption applications, the assessing office will be open to the public from 8:30 a.m. to 12:30 p.m. and closed in the afternoons “so they can process everything that is coming in,” she said.

During the limited hours, applications can still be dropped off to a lockbox at the Assessor’s Office at 24 Court Street, as well as mailed or emailed.

Lafleur said the assessor’s office is crunching the exemption numbers with the Department of Revenue in preparation for the setting of a new town tax rate by the Select Board.

“It’s very helpful for people to apply early, because then the numbers we’re working with are more firm than estimated,” Lafleur said. “We appreciate the public doing its part to file early.”

The Board voted in August to establish the residential exemption. It will shift Concord’s tax burden to the most highly valued homes as the town shoulders more than $100 million in costs for the new middle school now under construction.

Under the exemption, the town will look at the housing stock and calculate the average value of a Concord home. Ten percent of that number will be subtracted from the assessed value of every house or condo whose owner occupied it as their primary residence on January 1, 2023.

Importantly, the 10 percent will only be taken off a home’s tax value if the owner actively applies for the exemption by submitting an application and supporting documents. (See sidebar.) The property will then be taxed at a new tax rate the Select Board will set this fall. The current tax rate is $12.96.

The most modestly valued Concord homes stand to see the biggest reduction in their taxes with the exemption applied. Homes near the average value will see a smaller change. Tax bills for the highest-valued homes will go up.

Responding to a question from Board Member Terri Ackerman, Lafleur said Concord has approximately 6,000 residential properties. That would mean roughly a third of eligible property owners had applied as of the beginning of this week. Commercial properties and rentals aren’t eligible.

Select Board members have worried that owners of more expensive homes may be under the mistaken impression they won’t be helped by the exemption.

At Monday’s meeting, Chair Henry Dane re-emphasized that “everybody, at whatever level their property is assessed, [will] benefit from filing.” While owners of the priciest homes will pay more in taxes under the new rate, he said, their bills will still go up less if they seek the tax break.

And countering a letter to the editor published in the October 20 edition of The Concord Bridge, Dane argued the tax is equitable “in the same context that a graduated income tax is equitable.”

The new system is “based on the assumption that those who have more are better able to bear the cost of building the schools and providing essential services,” he said. “We see this as one small way in which we can help maintain whatever little economic diversity remains in our town.”

Homeowners who successfully apply for the exemption by or before November 1 will start seeing the effect in their January 2024 bill.

The final deadline to apply is April 1, 2024.