By Sarafina Zhang — CCHS Correspondent

What’s one of the most valuable lessons you can learn in high school?

It might be how to handle the real-world challenges of making budgets and managing money. And that’s why Concord-Carlisle High School hosted “The Game of Life Reality Fair” for seniors on May 10.

Organized by Melea Ray, the goal was to help equip students with crucial tools to deal with budgeting and money management.

Each student received a detailed life biography with random economic factors. The sheet included an annual salary, net monthly income, and expenses.

I was a nurse with an annual salary of $76,640. My gross monthly income was $6,386.67 — but after taxes, my net dropped to $3,975.70.

Said one quizzical student, “Why is FICA on there twice? Wait… what is FICA?”

Keeping track

It may be tempting for many people, especially young adults, to live without a plan and spend money on whatever they want. However, as we found out, it’s important to track expenses to ensure you don’t fall into a vicious cycle of debt.

The expense categories included Banking-Loans, Transportation, Housing, Pets, Vet Care, Luxury Items, Food, Internet/Phone/TV, and Travel, with options for Insurance and Retirement Savings.

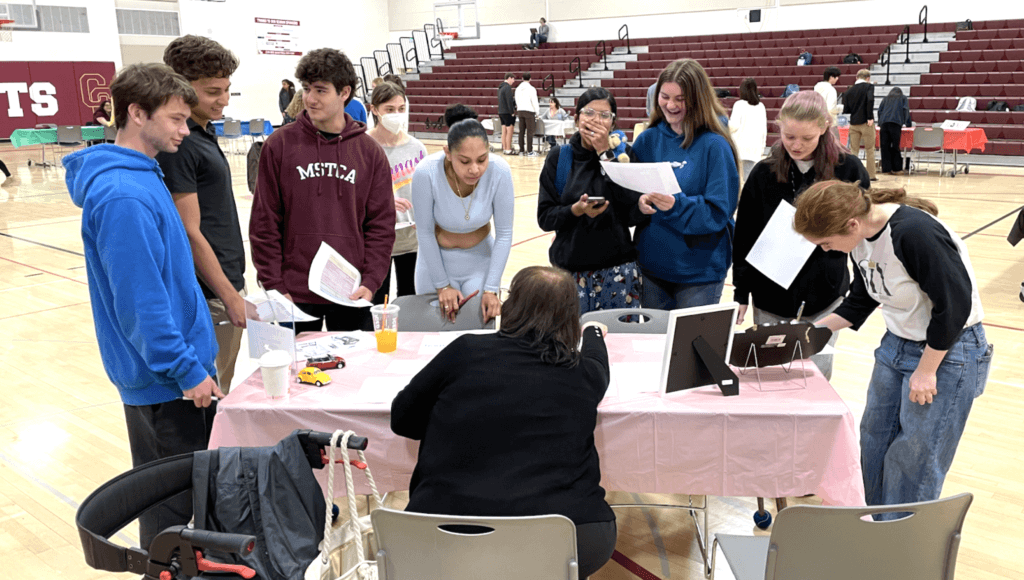

There were tables throughout the gym for each category. At each, a community member in the business would explain the expense, present plans with different monthly costs, and guide the student into making wise choices.

The goal: To live within one’s means.

How would I do?

I first checked out the Housing table and spoke with a Keller Williams real estate agent.

I felt that for a young nurse, it would be more practical to rent for a few years before taking out a loan for a condo or house. Boston was the most expensive place to live, Concord was in the middle, and Worcester was most affordable.

“Oh my gosh, I definitely can’t afford to live in Concord,” one student said.

(The last option, living with one’s parents, would cost close to nothing. One exasperated student declared, “I’m just going to live with my parents for, like, forever.” Every parent’s worst fear!)

I eventually decided to rent a one-bedroom apartment in Worcester at $1,500 monthly. Unfortunately, I also had to pay $20 a month for renter’s insurance and $200 for utilities.

Afterward, I headed to the Middlesex Savings Bank table. As a nurse, I had attended four years of college already, so I had more than $60,000 of student loan debt — roughly $692.54 monthly.

Photo by Sarafina Zhang

A spin of the wheel

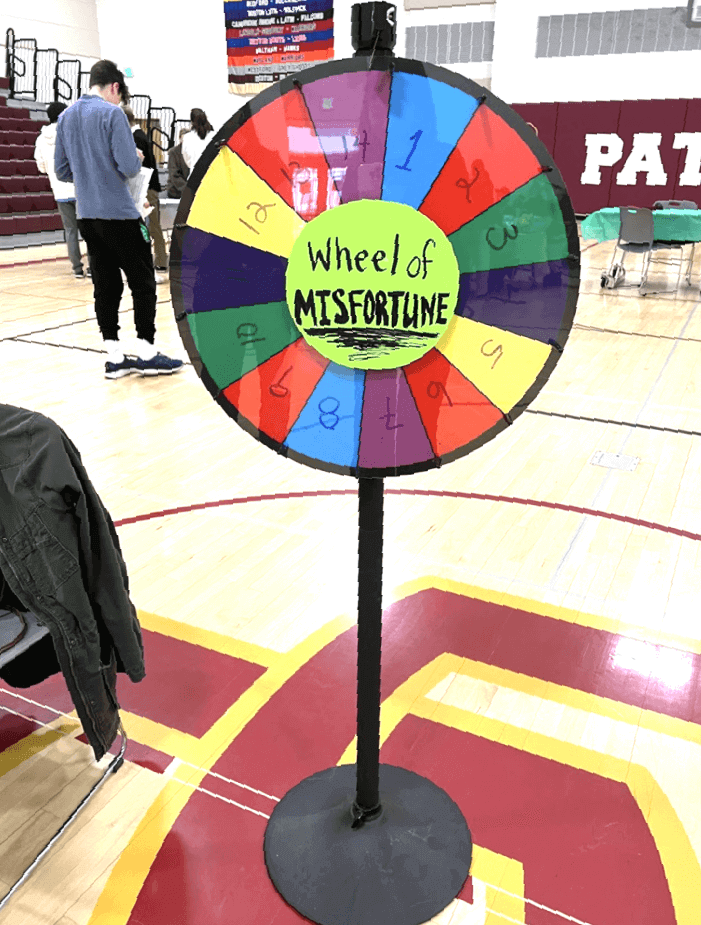

Next, I went to the Luxury Items table and splurged on retail/shopping at $100 monthly, and after that, the Wheel of MISfortune, which represented the mandatory expenses of unlucky setbacks and emergencies. A former CCHS teacher, Linda Vice-Hicey, was in charge.

My wheel spin meant I needed to travel to a friend’s wedding. Off I went to the Travel table. The cost of travel depended on the distance to the destination.

I assumed my friend’s wedding would be local, so it cost $40 monthly. Phew!

Others, I learned, dealt with much pricier problems, like astronomical vet charges.

Food on the table

I knew food would be another substantial expense, so I next went to that table, which was managed by The Concord Market. I chose the plan with groceries and pre-made meals at $660 monthly. (I felt this would be a good option for a nurse; although it cost more than groceries alone, nurses have rough days where they’d need a quick and easy meal.)

I then headed to Horizon, a spin-off of a local business, to view their phone/internet/TV plans. To save, I skipped TV and budgeted $130 monthly for phone and internet.

Since I was running out of money, I headed to the Transportation table last.

At first, I wanted a used car for $300 a month, but I realized I’d have to pay an additional $500 monthly for gas, minor maintenance, and car insurance. Also, I’d chosen to live in a city with public transportation.

In the end, I set aside $100 monthly to get around.

For the optional expenses, I decided to invest 5% of my income, or around $200, in a retirement account: I was informed employers would usually match up to 5% of a retirement savings contribution, and figured saving up early would benefit my future.

Photo by Sarafina Zhang

Counting the change

In the end, I subtracted my expenses, $3,443, from my net monthly income, $3,975.70, leaving $332. I’d succeeded!

While I was happy to have budgeted wisely, it wasn’t easy. I related a bit too much with a senior who said, “I don’t want to be an adult.”

Many students feel overwhelmed by the thought of managing one’s finances, because it may seem super complicated and adult-y.

However, the game format helped.

Also, students got to connect with community members experienced in various professions — from realtors to bankers — and receive personalized advice.

Overall, the reality fair was a thoughtful way to give seniors a head start on financial literacy.