If Concord residents don’t apply for the new residential tax exemption — and do it on time — it could cost them.

The Select Board voted in August to establish the new exemption, which will shift the residential tax burden toward the town’s more expensive homes as Concord stares down a more than $100 million price tag for its new middle school.

But the break doesn’t come automatically: Residents must actively apply by completing a form and providing tax documents by November 1 (early deadline, which will apply to the January 2024 tax bill) or April 1, 2024 (final deadline).

“Our intention is to get everybody who’s qualified” into the exemption program, said Select Board Chair Henry Dane. In most cases, he said, scoring the tax break requires just three things: “One, owning the property; two, living in it; and three, filing the application.”

Houses and condominiums occupied by the owner as a primary residence as of January 1, 2023 are eligible. Residents can only get the exemption on one property they own. Commercial and rental properties aren’t eligible.

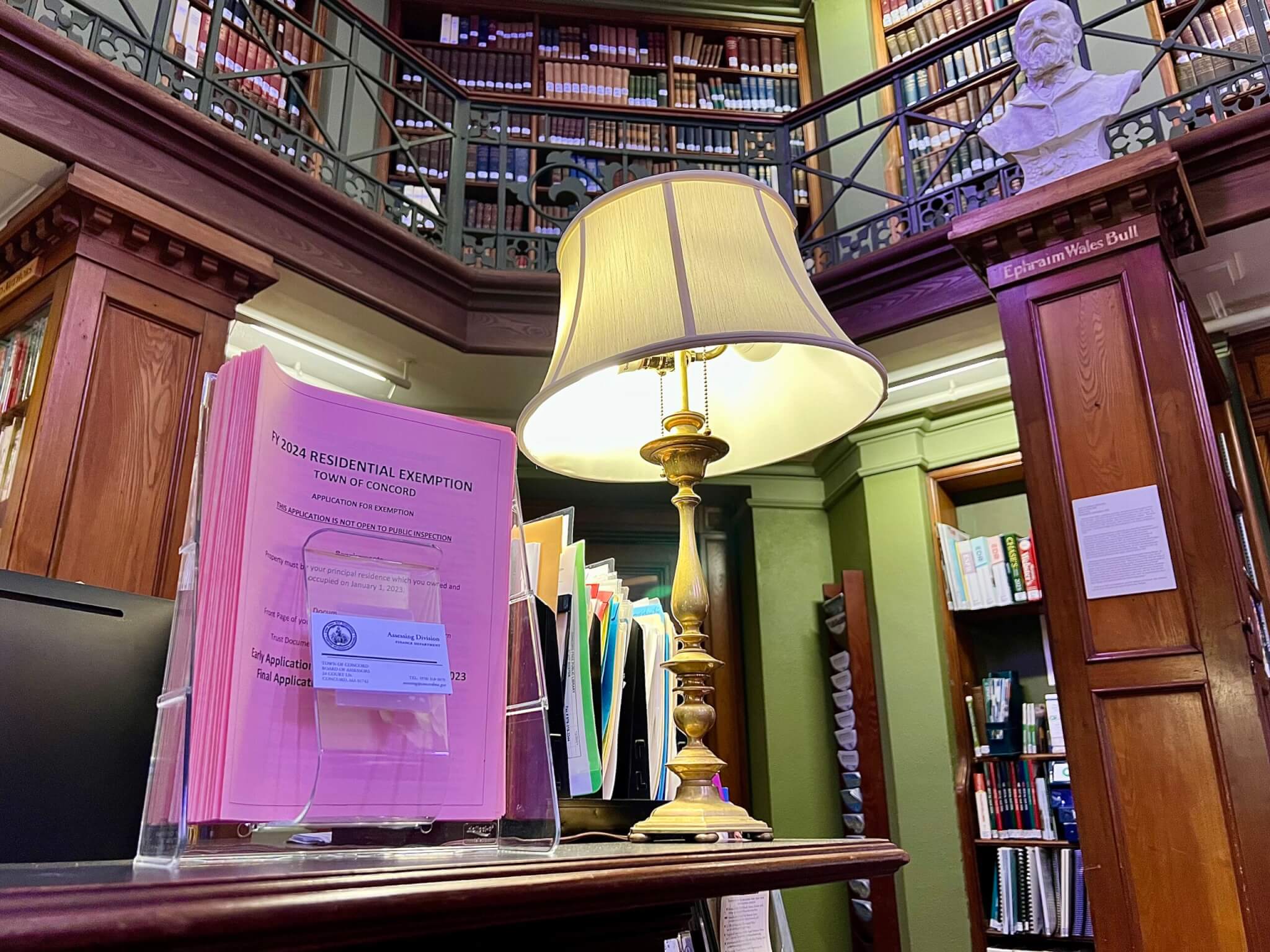

To get started, fill out an application. It’s available online at concordma.gov and for pickup at:

- The Assessor’s Office, 24 Court Lane;

- The Town House, 22 Monument Square;

- The Council on Aging, Harvey Wheeler Community Center, 1276 Main Street; and

- Concord Free Public Library locations at 129 Main Street and 1322 Main Street.

Also required with the application: A copy of just the first page of your 2022 federal tax return to prove residency. This single page must have all your personal information concealed except for the form title, the year of the return, and your name and address. Unredacted returns won’t be accepted.

For properties held in trust, also include a copy of the trust document that shows you’re a beneficiary.

Residents who didn’t meet the income threshold to file a federal tax return in 2022 can still get the exemption. Fill out the application blank, include a short note explaining that you weren’t required to file federal taxes, and prove your residency by including copies of at least two of the following documents:

- Both sides of your driver’s license;

- Your motor vehicle registration;

- Your gun permit;

- The redacted version first page of your 2021 federal tax return; or

- Another 2022 federal form showing your home address.

If your 2022 federal return lists a post office box as your address, send a copy of the redacted first page and provide a copy of one of those documents — such as a driver’s license or car registration — as proof of where you live and pay tax.

Mail your completed application and documents, postmarked by April 1, 2024, to the Assessor’s Office at 24 Court Ln., Concord, MA 01742; drop it off at the Assessor’s Office in person; or email it to assessing@concordma.gov by 4:30 p.m. on April 1.

The sooner you file your application, the sooner you could see a difference in your tax bill.

Qualified homeowners who file by Wednesday, November 1 will see the exemption divided between their January and April 2024 tax bills. Those who miss the November deadline but successfully apply by the final deadline of April 1, 2024 will see the full impact in their April bill.

Those who miss the April 1 filing cutoff are out of luck for this round of exemptions. Residents who think their applications have been denied in error can ask the Board of Assessors to review their case.

For more information on Concord’s residential tax exemption, visit concordma.gov, contact the Assessor’s Office at (978) 318-3070, or email assessing@concordma.gov.