By Sean Flannelly — Correspondent

In its debut year, Concord’s new residential tax exemption attracted more than 3,500 applications.

“It was uncharted territory for us,” said town Chief Financial Officer Anthony Ansaldi.

Assessor Meredith Stone “and her team did a ton of work — it wasn’t easy,” he said. “They worked really hard to do it [on] top of the regular work they do.”

Now comes the work of assessing what the exemption meant to the town.

Last August’s vote to green-light the RTE locked the town into the program for 2024. Going ahead, the Select Board will assess could change the exemption percentage. It’s currently ten percent. By state law, the town could make it as high as 35 percent, but Hartman is “sure the Select Board does not have that intention.”

The program shifts the tax burden from owner-occupied, lower-value houses and condos to higher-value homes, apartment buildings, and vacation properties. Ansaldi said the average savings per homeowner is about $1,800, though that number will change each year.

While the RTE has a more potent effect on the tax bills of less expensive homes in this town of 5,700 residential properties, the town encouraged every qualified homeowner to put in for it.

“If you didn’t apply, you were leaving money on the table,” Hartman said.

More research required?

The Select Board unanimously approved the RTE, but the program had its detractors before, during, and after the vote.

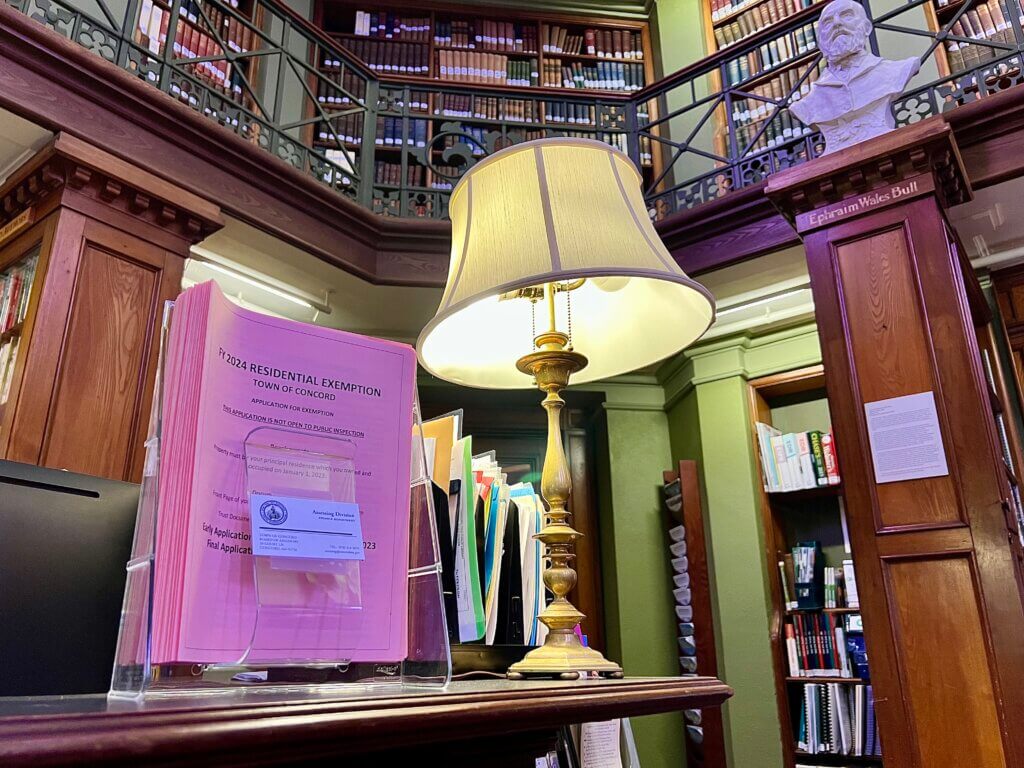

Photo by Celeste Katz Marston

Some residents think the Board moved too fast, and Joe Laurin, who said so ahead of November’s formal approval of the exemption, still feels that way. He worries the exemption could unintentionally hurt seniors with both high-value homes and low fixed incomes while giving a break to residents who don’t really need it.

“Home value and ability to pay taxes are two very different things,” said Laurin, who ran in April’s Select Board race.

“Why can’t we just expand the notion of the senior tax exemption instead of creating this new thing?”

Nicole Saia, social services supervisor at the Council on Aging, said the center did help many older residents apply. She said the break has been especially helpful to fixed-income seniors who are longtime property owners.

In a letter to The Concord Bridge last year, resident Lindsay Gillis pointed to a 2019 RTE study in Lexington. That town decided against the exemption in favor of advocating for a means-based policy and promoting existing breaks.

Concordian Scott Smigler agrees there are better tax policies for helping the community, such as expanding the senior exemption that voters made permanent in June.

Smigler said the RTE is well-intentioned, but mainly used by larger cities like Boston and Cambridge and communities with many properties not occupied by the owner, such as on the Cape and islands. “None of Concord’s peer communities have adopted the RTE — it’s not good policy, and it’s divisive,” he said.

Resident Breht Feigh also says “there’s a lot more work that should have been done.”

He argues the RTE doesn’t necessarily address the problems the Select Board is trying to solve. He’s also concerned about unintended consequences, such as landlords passing on their new tax burdens to renters and owners of high-valued homes shouldering more extra burden than intended.

The first round of tax increases related to the Concord Middle School debt exclusion also went into effect this year, leading to higher taxes all around.

‘The only tool available to us’

Both sides of the RTE debate have called the policy a “blunt instrument” that doesn’t target low-income residents — only owners of lower-valued homes.

West Concord resident Mari Weinberg, who’s spoken in favor of the RTE, says “like democracy, it doesn’t work perfectly, but it’s the best [thing] we’ve had.”

In her personal case, “I am turning 80. I am on a fixed income. I have lived here 45 years — and with a fixed income and taxes getting higher and higher, I have to keep digging down in the same pot, and I’m afraid I’m going to outlive my money,” Weinberg said.

“There are people like me who want to stay here. We want to age in place.”

Housing Authority Chair Stephan Bader agrees the RTE is “not perfect, but it’s the only tool available to us under current Massachusetts law.”

While Bader was a bit disappointed by the rollout and the town’s communication about the process, he called it a “good start” that can “only be improved upon.”

Mike Mahoney, a realtor who lives in town, said the RTE has helped a lot of people already — both existing homeowners and new residents moving in.

Mahoney said mortgage lenders consider expected property taxes when issuing a loan, and the exemption helps buyers who might not otherwise be able to afford Concord.

“I sell properties in a lot of other towns that have the exemption, and it makes a huge difference,” he said.

Stay tuned for updates

Photo by Celeste Katz Marston

The Select Board’s Hartman said the RTE shift “went really well” and that the reasons for enacting the exemption “still hold.”

However, she said, the impact on tax bills may have been overshadowed by the middle school debt and higher overall spending. She said she looks forward to finding out how many people were actually helped —and what the real tax impact was for Concord residents.

Ansaldi said he will update the Select Board in August or September; Stone said the review process could include a resident survey.

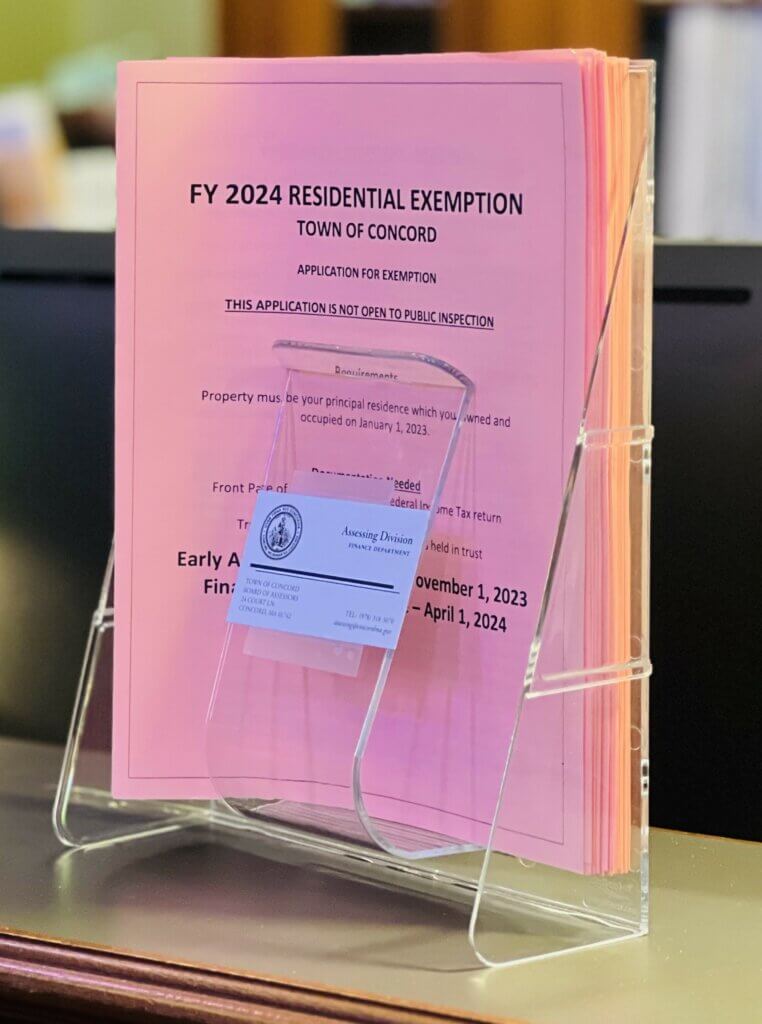

The town is now accepting RTE applications for 2025. The form is available at the Assessor’s Office, Council on Aging, Treasurer’s Office and online.

Once a homeowner’s application is processed, they do not need to apply again, which is good news for both residents and the Assessor’s Office: Stone said they expect a smaller volume of applications if the exemption is approved for a second year.

Refresher: How the residential tax exemption works

Concord’s residential exemption lowers the valuation of each home for tax purposes.

The Select Board enacted a 10 percent RTE. That means the exempted value is equal to 10 percent of the median price of a home in Concord, or just under $1.43 million. Ten percent, or a little less than $143,000, was deducted from the valuation of each qualifying home before its property tax bill was calculated.

The exemption amount is the same for all eligible homeowners, regardless of their income or property value.

In effect, the policy reduced the total taxable assessed property value of the town for this year by more than $500 million. As a result, the tax rate went up to generate the revenue needed to run the town.

For lower-value homes that get the exemption, the net effect of the policy is a tax break. The resident’s property taxes may still go up, but they’ll pay less than they would have without the exemption.

For higher-value homes that receive the exemption, the net effect of the policy is a tax hike.

Eligible homes close to Concord’s “break-even point” of about $2.1 million see little to no impact of the exemption on the owner’s tax bill.

Owners of properties that don’t qualify for the exemption — such as apartment complexes or vacation properties — will pay the higher tax rate on their full assessed value, resulting in the biggest tax increase.